Business Loan of 10 Lakh

- IIFL

- Business Loans

- Business Loan of 10 Lakh

Get Business Loan

Get a Business Loan of ₹10 Lakh – Quick & Easy Funding from IIFL Finance

If you're a small or micro business owner aiming to take your venture to the next level, IIFL Finance has the right solution for you. We offer business loans of up to Rs.75 lakhs, making it ideal for entrepreneurs seeking a Rs.10 lakh business loan or more. Whether you run a retail shop, a manufacturing unit, a trading firm, or a healthcare practice—or you're a freelancer needing to upgrade your equipment—we offer tailor-made loan options to meet your needs. Our flexible offerings are designed to support growing startups, local businesses, and self-employed professionals across diverse industries.

Features and Benefits of a 10 Lakh Business Loan

-

Unlocking Growth Potential: With access to a significant loan amount of 10 lakhs, you can invest in crucial areas like product development, office spaces, manufacturing, expansion, sales & marketing, and inventory.

-

Collateral-Free Convenience: Unlike traditional loans that expect you to pledge assets as collateral value, the 10 lakh business loan is unsecured and does not require you to tie up your valuable resources, allowing you to maintain financial flexibility. Thus, you don't stand a chance of losing those assets in case of unforeseen circumstances.

-

Fast Funding, Faster Action: You need not wait for weeks or months for a loan approval. IIFL Finance ensures you get 10 lakh business loan at lightning speed once the approval has been sorted. This rapid turnaround allows you to seize time-sensitive opportunities or address urgent needs.

-

Flexible Repayment Solutions: You can tailor your loan repayment as per your convenience, depending on the business cash inflow. The flexible tenure options stretched up to eight years. This ensures manageable repayments that don't strain your budget.

-

Simplified Process, Speedy Approval: The streamlined online application process minimizes paperwork. Since it is entirely digital, the approval process gets expedited as well. The funds can be transferred into your account as early as 48 hours on approval.

-

Competitive Interest Rates: IIFL Finance offers competitive interest rates, making this loan a cost-effective way to secure substantial funding. They consider your creditworthiness and business health to determine the final rate, ensuring a fair and transparent process.

Eligibility Criteria for 10 Lakh Business Loan

For a 10 lakh business loan eligibility, you are required to meet the following expectations:

-

Age: when you apply for 10 lakh business loan, you must be between 23 and 65 years old and still be below the age of 65 by the end of the loan tenure period.

-

Business/Venture Age: The business should be running for at least 3 years with a clean record free from any form of blacklisting.

-

Creditworthiness: A minimum CIBIL score of 700 demonstrates your financial responsibility and thus raises your chances of a loan approval.

-

Bank Account: It is mandatory that you have a current bank account.

What is a Business? A business is an organization…

In today’s dynamic economic landscape, financing…

Micro, Small, and Medium Enterprises (MSMEs) play…

Business owners consistently need adequate capita…

For every successful business that was once just a…

Every business needs constant capital to ensure e…

Besides strengthening the establishment of a busin…

Understanding the Goods and Services Tax (GST) is…

The ability to finance operations is essential fo…

Maintaining sufficient funds to meet your operatio…

Most businesses, whether in agricultural, manufac…

In Indian metro cities today, most parents are wo…

Women's empowerment and self-sufficiency are amon…

Working capital is a fundamental concept in financ…

If you are an MSME owner struggling to access gove…

Are you sick and tired of the daily 9-5 grind? Do…

Running a business smoothly requires a constant f…

Starting an enterprise with an established busines…

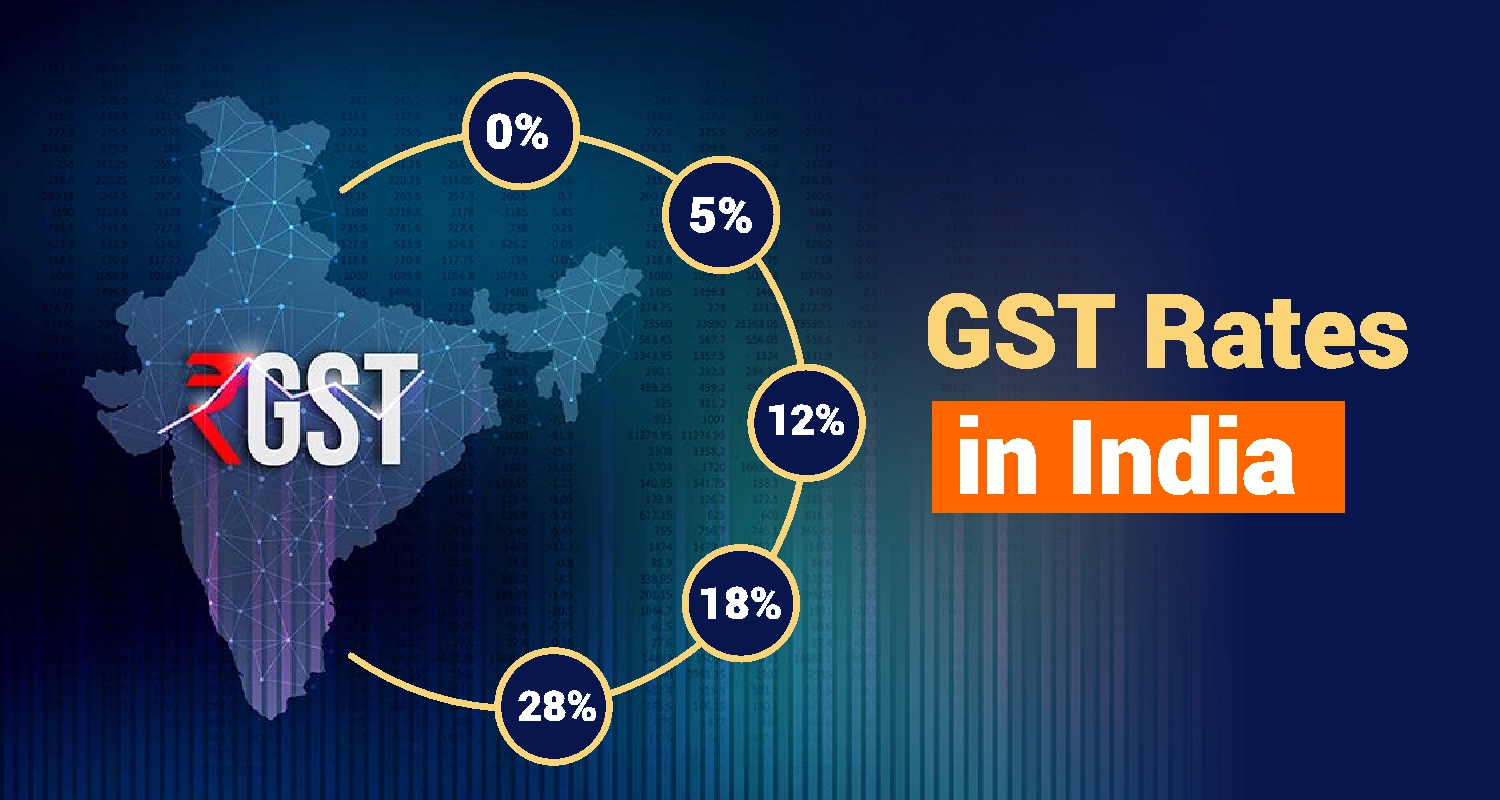

Goods and Services Tax (GST) rates are vital for e…

Goods and Services Tax (GST) applies to food items…

The Goods and Services Tax (GST) has transformed I…

The Goods and Services Tax (GST) in India is a uni…

Another popular business model that has emerged in…

A business succeeds on various principles; startin…

West Bengal, also known as Paschim Banga, is home…

Perched between the lush Eastern Ghats and the Bay…

Jaipur has a rich historical tradition and is a co…

Today's job market is highly competitive, and educ…

!Micro, Small, and Medium Enterprises (MSMEs) play…

The automotive industry continues to expand as veh…

Hyderabad, a booming city, stands as a hub of oppo…

Many individuals dedicate significant effort to fu…

A pharmacy business in India is a lucrative ventur…

People are often unsure about the next step in the…

India has been home to handicrafts over centuries…

The Indian real estate sector is projected to hit…

Are you thinking of turning your passion into a bu…

Starting a driving school business in India can be…

All businesses begin with a vision and share one f…

Opening a yoga studio at home can be a fulfilling…

Today, looking good isn’t just about style. The ne…

If you're wondering how to start a stationery shop…

Creating a piece of jewelry could be a hobby for m…

Gone are the days when dining out was the only way…

Are you interested in starting a digital marketing…

Choosing to eat out is not always the best option.…

Imagine you've landed your dream job in a bustling…

We live in an age where electrical gadgets are mor…

Starting a hardware business may be a rewarding ve…

Cold storage is a powerful solution to preserving…

When you intend to start a small business, it is b…

How do we arrive at 4 mathematically? 2 times 2, 2…

Gold has been at the heart of Indian Culture from…

Saving money can be confusing even for the most ma…

With rising lifestyle health concerns due to dieta…

As small businesses are in the spotlight of late,…

Imagine you're starting a delicious food stall sel…

Cash management is a critical aspect of any busine…

When you start a business, what is the first quest…

Are you looking at tapping into India’s all-time h…

In today's rapidly evolving business landscape, ad…

Every month, when you get your salary or your pock…

Are you a business owner? If yes, you might have o…

Are you fond of automobiles and like to care for t…

Did you ever find yourself baking late into the ni…

What if you get to know of a business that besides…

Imagine being a solar entrepreneur in 2025, an era…

Can you imagine a scenario where your company’s cu…

Would you like to consider investing in a portfoli…

With the growing complexity of the Indian economy,…

The world has gradually tiptoed into your lives. Y…

Entrepreneurs and Managers are the two pillars of…

Can you say what sets successful entrepreneurs apa…

The boundaries of commerce are being redefined by…

Your next big break might just be an elevator ride…

Can you imagine doubling your investment every few…

What is eWay Bill? The electronic way bill serves…

The Goods and Services Tax (GST) introduced in 20…

In the business world, mistakes happen, and somet…

The year 2017 saw a paradigm shift in the Indian…

You may wonder, why some entrepreneurs transform e…

Can you visualise a business that runs with the po…

Businesses in the world drive the economy by contr…

It is interesting to know that India's economic la…

Our lives are dependent on the next purchase we ma…

There has been a paradigm shift in the shopper in…

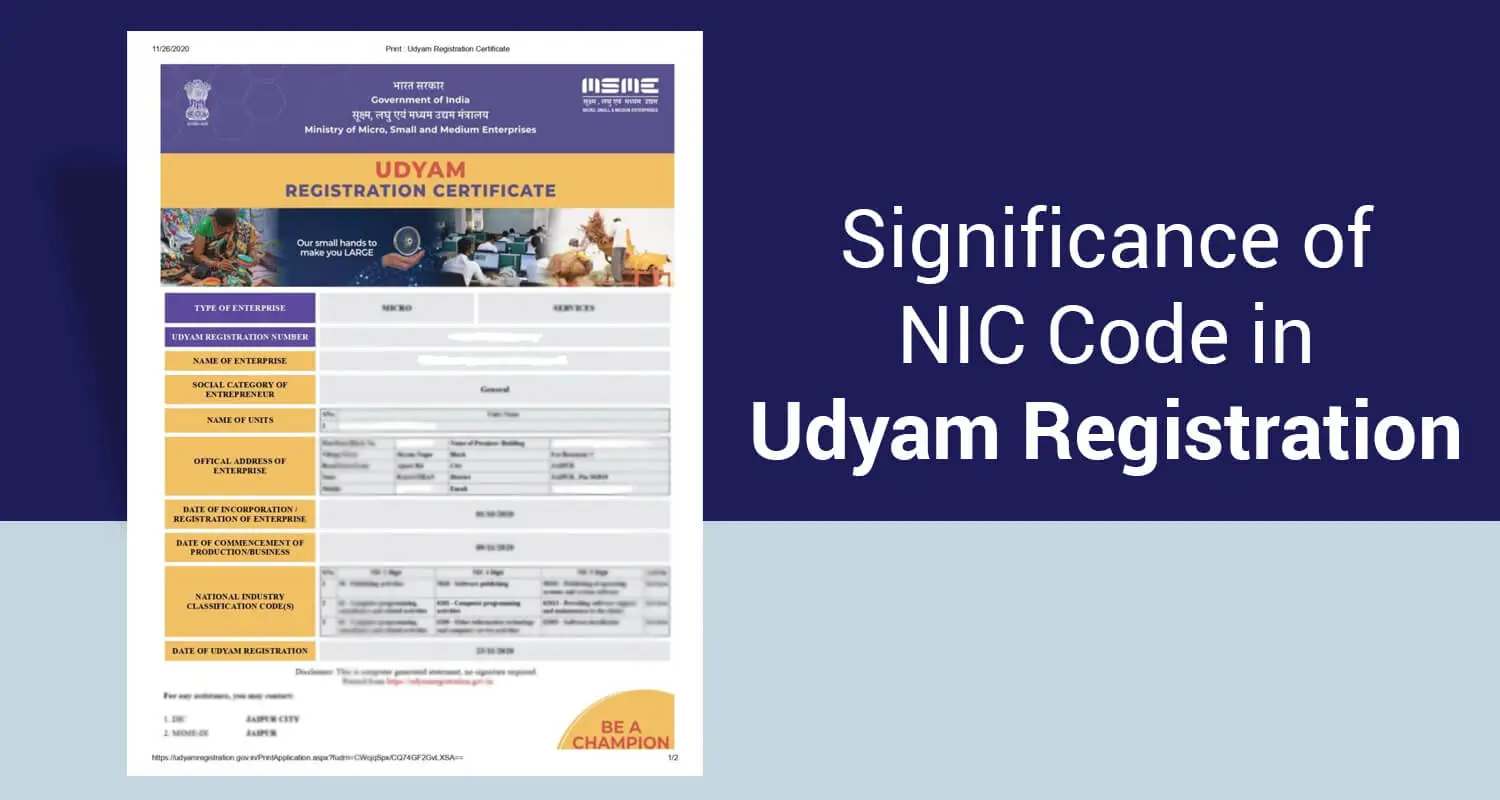

What is a NIC Code? The NIC Code, National Indus…

Replacing multiple indirect taxes, the Goods and S…

Have you ever faced a business failure? It is quit…

A business model that combines the flexibility of…

How can you get a closer view of your business’s o…

Can the best way to serve society be a business’s…

Tax planning can be daunting, overwhelming, and ti…

A business idea is just an idea without the right…

Do you have a new business and want to enhance its…

Curious about the secret formula that businesses u…

Manufacturing businesses rely on equipment to man…

A business always needs finance for its expansion…

India's startup ecosystem is booming like never b…

The Micro, Small & Medium Enterprises (MSME)…

In today’s dynamic environment, the desire to own…

The purpose of business loan is to empower entrepr…

An efficient employee is an excellent asset for yo…

Since its inception in 2017, GST has been a comple…

Businеssеs everywhere arе constantly seeking inno…

In the digital era, Digital Signature Certificate…

While small businesses are the cornerstone of Indi…

Starting a new business in India can feel like a c…

Business transactions are the lifeblood of any org…

Are you planning to start a venture of your own? O…

Remember India's economic boom period between 2003…

Evеn as most banking sеrvicеs arе digitally availa…

Financial misfortunes in businesses come uninvite…

What is a Business? "Business" comes from "busyn…

Kerala is one of the most popular destinations in…

A business, big or small, always has scope to imp…

We often begin planning our investments as soon as…

India is primarily an agricultural nation. Recogni…

Starting your own business can be an incredible jo…

Launching an e-commerce business or expanding your…

Understanding the Point of Sale (POS) under the Go…

The Goods and Services Tax (GST) regime in India h…

Imagine you have an investment that will give you…

In personal finance, a credit score holds immense…

The growing economy has paved the way for many to…

Starting a small business today, whether through…

Being a business owner of a Micro, Small, or Mediu…

The Coir Industry, employing over 700,000 workers…

With its expanding young population and growing e…

Retail businesses often face fluctuating cash flo…

The Indian government, through the Ministry of Mi…

EBITDA stands for Earnings Before Interest, Taxes,…

During the last few decades, India has seen a rem…

During the past few years, micro, small, and medi…

The National Small Industries Corporation (NSIC) h…

The Goods and Services Tax (GST) is a comprehensiv…

The registered taxpayers must follow certain comp…

Most businesses' operations require goods transpo…

GST, or Goods and Services Tax, has transformed t…

For any business in India, understanding product…

Almost every business must adapt or change strate…

CGST and SGST are two important components of Ind…

GST, introduced in India in 2017, has revolutioni…

What is GST on Rent? We all are well aware of the…

GST(Goods & Service Tax), is a term you must h…

The corporate landscape requires a strong system…

The GST, or Goods and Service Tax, system has bee…

Micro, Small and Medium Enterprises (MSMEs) are th…

MSMEs (Micro, Small, and Medium Enterprises) serv…

Maintaining accurate financial records is paramoun…

Amortization might sound likе a complеx financial…

The world of finance thrives on capital – it fuel…

Business owners may need help with invoicing or re…

As we are all well aware, a letter of authorizati…

The term Goods and Service Tax exists for a reaso…

Running a business can be quite a challenge and ke…

Importing goods and commodities across borders is…

Every business, big or small, needs capital to fu…

In today’s crowded marketplace, whenever we pick…

Micro, Small, and Medium Enterprises (MSMEs) form…

The launch of MSMEs (Micro, Small, and Medium Ent…

Running an MSME (Micro, Small, and Medium Enterpr…

Even as many banks, financial institutions, and g…

When a business owner applies for a business loan…

A business loan is broadly a line of credit given…

Capital is the foundation for any business. A bus…

Many young and middle-aged individuals often desi…

The global outbreak of the COVID-19 pandemic in 2…

Dreaming of starting your own business, expanding…

Imagine a world where every business transaction,…

Navigating the world of Goods and Service Tax (GS…

Ever found yourself puzzled by the "amortization s…

So, you're fueled by passion, armed with a groundb…

Remember that glorious feeling of launching your…

The availability of finance is crucial to the succ…

Some purchases are so easy to make as it does not…

Peer-to-peer lending has emerged as a dynamic and…

NIRVIK scheme (Niryat Rin Vikas Yojana) was intro…

लोन, अब हमारी ज़िन्दगी का ज़रूरी हिस्सा बन चुके हैं…

देश की तेज़ी से बढ़ती इकॉनमी ने लोगों को अपना बिज़ने…

बिज़नेस लोन आपकी बिज़नेस से जुड़ी फंड की ज़रूरत पूरा…

The dynamism of the business and start-up world to…

Starting or expanding a business often requires f…

Micro, Small, and Medium Enterprises (MSMEs) play…

Turning your passion into a full-fledged career i…

One of the main pillars of any business venture i…

Getting a business loan can be a game-changer for…

Businesses today operate in extremely competitive…

Staying ahead in a business, ensuring profit is e…

Freezing cherished moments in snapshots is a hear…

Securing adequate capital is vital for both start…

A No-Doc Business Loan or a No Documentation Busi…

To thrive in a competitive landscape, businesses…

When applying for commercial loans, lenders evalu…

People borrow money for distinct reasons--to beco…

With the changing dynamics of the business world,…

A person may need emergency fund anytime, includi…

Starting a home-based business is just like start…

In today’s digitized world, starting a business a…

Working for others can sometimes lack variation a…

Logistics business, sometimes believed to be a cr…

The Micro, Small, and Medium Enterprises (MSME) s…

Adhering to rules and regulations is important fo…

A clear vision is what differentiates an organisa…

Running a business without adequate funds becomes…

भारत में अधिकांश सूक्ष्म, लघु और मध्यम उद्यमों (M…

Every business needs money to grow and even survi…

The key to any successful business is a solid fi…

The thought of starting a small business often cr…

Have you ever called someone over for home cleani…

Starting a business can be challenging. With the…

किसी भी व्यवसाय में वित्तीय समस्याओं को कम करने क…

It can be tempting to quit your 9-to-5 job and st…

A good deal of hard work and adequate monetary su…

Starting a business with zero investment – is tha…

Starting a business may appear enthralling but ru…

Running a successful business is certainly not ev…

Business growth as a term can have different mean…

Mumbai, India’s financial capital, is the city of…

Businesses require a capital infusion at every st…

Short-term business loans are taken by business e…

All lenders assess the eligibility of a loan appl…

Every small business needs money from time to tim…

Almost every business, big or small, requires cre…

As a minority, at times, it is tougher to start a…

A business loan is essentially credit—with or wit…

Every business, small or big, needs credit from t…

A business venture needs money and human resource…

Almost every small business needs to borrow money…

A business entity and its representatives are sep…

Working capital refers to the funds a company use…

If you plan on getting a small business loan, you…

Funds are essential for any business, irrespectiv…

The basic objective of an entrepreneur is to not…

Small Business Administration (SBA) loans provide…

Financial capital is necessary for starting any t…

A business needs money to start operations as wel…

It will not be an overstatement if one were to sa…

A business loan is simply a line of credit grante…

Continuous supply of money helps a business to su…

Every business, irrespective of its size, needs f…

Women entrepreneurs have battled for generations,…

Funding greases the wheels of a business. While s…

Many businesses need additional funding at some p…

Fast access to working capital is crucial for bus…

Entrepreneurs require constant capital to ensure…

Loans are often useful to pay for planned and unp…

Small businesses are the backbone of the Indian e…

Raising external capital is one of the most cruci…

MSMEs are the backbone of the Indian economy. The…

A company requires capital to invest in various b…

Nearly every small business needs money from time…

Starting a business may be easy. But running it s…

All small, medium and large-scale businesses requ…

Every business howsoever small or large needs mon…

In India, the youth between 15-29 years old compr…

Micro, Small and Medium Enterprises are the main…

The National Institution of Transforming India (N…

Banks and non-banking finance companies (NBFCs) o…

First introduced in March 2020, production-linked…

India is the land of businesses. However, with ma…

MSMEs (Mirco, Small and Medium Enterprises) have…

With the advent of technology, digital banking ha…

The Indian government's Ministry of MSME launched…

To increase the farmer’s income, provide irrigati…

Every business, whether big or small, requires ex…

According to the Government of India, people are f…

Businesses in India are the backbone of the econo…

The Indian government issues numerous identificat…

The introduction of the Goods and Services Tax (GS…

Business loans help entrepreneurs raise immediate…

India is pacing swiftly towards being a developed…

India has become the third-largest startup ecosys…

India is witnessing record volumes of investments…

Entrepreneurs need to plan for their financial re…

Every business requires money to run operations a…

Entrepreneurs running a small or large venture ar…

Every business needs money from time to time. And…

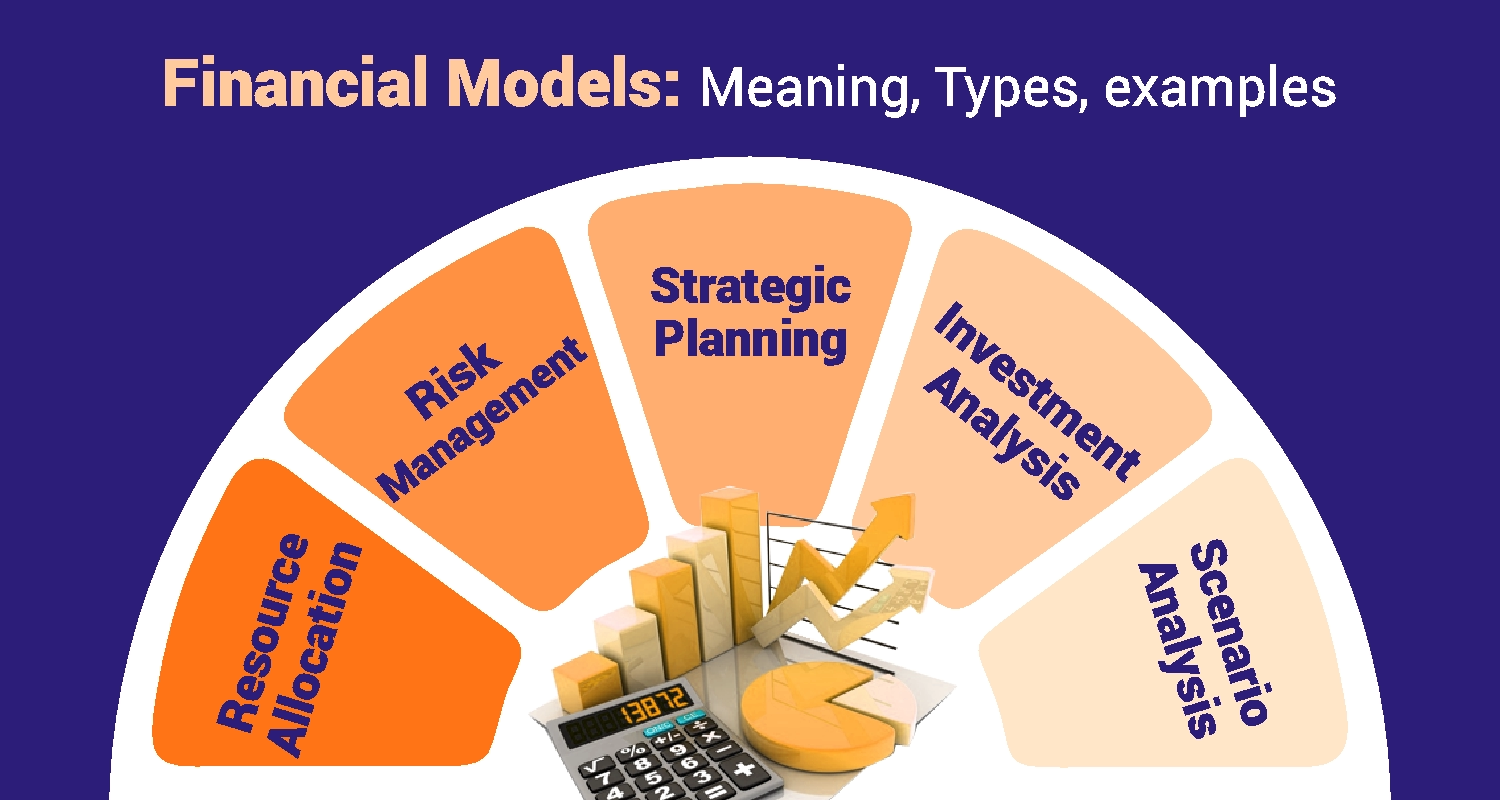

Working capital management meaning in simple words…

The travel and tourism industry in India, like mo…

Entrepreneurs and business owners understand the…

An entrepreneur is intrinsically connected to his…

India is advancing towards a digital-first econom…

When any entrepreneur starts a business, the one…

Business loans allow entrepreneurs to raise immed…

Funding your needs with a loan is a common phenom…

The success of any entrepreneur depends to two se…

Business owners need capital to drive operations…

Small businesses often need debt to either keep th…

The most basic requirement for an enterprise is f…

Capital is essential for any business. Without ad…

A business loan is an excellent way to meet an or…

Business loans can be a saviour for entrepreneurs…

Working capital is essential for starting a busin…

Many business owners often believe that how passi…

Every business needs a certain amount of money to…

Business loans have become a saving grace for ent…

Businessmen looking to begin a new venture or to…

Banks and non-banking finance companies (NBFCs) a…

A business loan can take various forms. While som…

Many entrepreneurs believe how they run their bus…

Managing the affairs of a business and to scale i…

In a business, unforeseen costs might occur at an…

Fortunes of a business venture are intrinsically…

Finance is the most critical part of running a bu…

Non-profit organisations have become the driving…

A loan default can severely impact your creditwor…

After the US and China, India is the third larges…

Taking a business loan may require a cosigner if…

When your business performs well, prepaying a bus…

Running a retail store has many challenges, inclu…

Undoubtedly, your investment capital is essential…

Credit scores are essential when looking for a lo…

A business has diverse options to raise funds: Ve…

At some point, your business will need fast acces…

Some chartered accountants prefer working for fir…

Individuals and entrepreneurs need to choose betw…

Food is the basic necessity of life and has an ev…

As a business owner, you may find yourself in a s…

Business loans are financial products that banks…

Today, women entrepreneurs are conquering the bus…

Business owners need capital to ensure the smooth…

Many Indian companies are into manufacturing vari…

Individuals execute financial transactions daily,…

Taking a business loan for the first time can be…

Recently, business loans have become popular amon…

Business loans are a widely used financing mechan…

Entrepreneurs with a recently formed business nee…

Capital is crucial to start, operate, and expand…

An entrepreneur interested in starting a new busin…

While taking a business loan, lenders seek a borr…

Businesses of any size can benefit from business…

A business loan is the best way for a company to…

India is witnessing a digital revolution, especia…

Business loans are ideal for raising adequate cap…

A cash-flow issue shouldn’t signal the end for a…

The MSME sector is one of India's primary growth…

An idea without execution is nothing. Similarly,…

With a good business plan, you also require fundi…

There are various ways to get the cash influx whi…

Micro, Small, and Medium enterprises (MSMEs) have…

Since the launch of the Startup India initiative…

Running a business includes many responsibilities…

A GST business loan is an unsecured loan that all…

Many entrepreneurs find it difficult to avail of…

Recently, the volume of women entrepreneurs creat…

Equipment Financing allows business owners to rai…

Business owners need constant capital to ensure t…

Money is the lifeblood of any business. But this…

Working capital is the amount a business needs to…

When taking a business loan, borrowers are legall…

Operating a business is complex. Sometimes, a dis…

Acquiring a loan for a business in India requires…

Digital technology in the financial sector has ma…

NBFC business loans are a type of loan product th…

Every organisation, regardless of size, depends o…

Whether you are just starting or expanding your b…

Growing businesses have growing needs. Your busin…

Micro, small and medium-sized enterprises (MSMEs)…

Almost every business, big or small, needs to bor…

Almost every startup needs money for working capi…

The micro, small and medium enterprises (MSME) se…

Every business needs to buy or lease equipment wh…

Many borrowers, with inadequate income or no cred…

Limited capital can thwart the growth plans of an…

Logistics is the backbone of any business that of…

Many small and medium-sized business owners hesit…

Small and medium-sized enterprises (SMEs) often h…

For most micro, small and medium enterprises (MSM…

Financial crisis are unanticipated and, if not at…

Every business, irrespective of size or the secto…

The interest rate is one of the most important fa…

International trades interconnect economies world…

Bankruptcy is a dreaded scenario for any business…

The composition of Indian homes has changed signi…

Running an interior design business requires a go…

The Indian population is growing, which means tha…

Capital is one of the fundamental requirements to…

Opticians are in high demand as people need their…

To run a successful clothing boutique company, yo…

Starting a new business is difficult, and many of…

The demand for electric vehicles is on the rise.…

Financial crises can occur at any time. However,…

The first thing you need to assemble your manufac…

Companies have relied extensively on traditional…

Cash flow may not be consistent while running a b…

Over the past few decades, the beauty industry in…

Building a product is one thing, and selling it a…

A quick loan can be the best way out of a financi…

Small business owners consistently seek adequate…

Setting up a business can prove to be challenging.…

The Parliament passed the Goods and Service Tax (…

In 2021, 1600+ Indians searched for "How to get a…

Money is the most critical ingredient for startin…

Debt is a liability and the sooner it is cleared…

Building a business, whether it is a large firm o…

A journey to start and nurture a business can be…

The best moment in life is when your dreams come…

COVID-19 has been a nightmare for many small busi…

MSME loans cater to the capital requirement needs…

Since the pandemic, most people have become wary…

The Covid-19 pandemic led to a sharp slowdown in…

The emotional burden of borrowing money from famil…

A business loan is a convenient way of availing c…

Financial independence is important for every ind…

Every business has certain goals to attain, but s…

Every business needs ready money to meet day-to-d…

Finance is the foundation of any business. Any fi…

Over the past few years, the Indian government ha…

An entrepreneur or a business owner comes across…

Life is full of uncertainties, as the Covid-19 pa…

Businesses, both big and small, have many day-to-…

Every business, big or small, goes through variou…

Acquiring new customers is a critical part of any…

Supermarkets often offer better discounts and an…

Working capital determines a company’s overall fi…

Every successful business invests heavily in exte…

Managing your debt can help you achieve your busi…

Oftentimes, businesses, both big and small, have…

Numerous factors in the success of the business d…

The survival of an organization in this competiti…

Starting a business from the ground up successful…

Technology plays a crucial role in the prosperity…

One of the many decisions when getting a business…

MSMEs (Micro, Small and Medium Enterprises) have…

Business loans have become one of the most popula…

Business loans have become an ideal financial ins…

Starting a new business is an exciting endeavour.…

India has become a startup hub, with numerous new…

The temporary suspension of domestic and internat…

Businesses require an infusion of capital for the…

Unanticipated financial obligations in business c…

Every entrepreneur think his or her business is s…

Micro, small and medium-sized enterprises (MSMEs)…

While starting a new business, the first thing yo…

Growing a business-whether it is a large company…

Loans are financial resources to fulfil all plann…

Establishing a business takes time, effort and, w…

Business environments change frequently, sometime…

India has established itself as one of the fastes…

Micro, small and medium enterprises (MSMEs) contr…

The unprecedented crisis during the Covid-19 pand…

For businesses to grow and expand, money is impor…

Micro, small and medium enterprises (MSMEs) form…

Any company or organization requires funds to sta…

When an entrepreneur starts to think of running a…

Micro, small and medium-sized enterprises (MS…

For entrepreneurs, getting loans to power their b…

When you are starting a business, the most importa…

Rewards and risks go hand in hand in business. A…

Every business needs money to cover day-to-day wo…

Managing a small and medium-sized business can be…

Cash flow is often considered as the lifeblood of…

Starting a small business in India has never been…

MSMEs are growth accelerators of any economy, and…

Growth of MSME sector which employs ~50mn people i…

Written by Govind Mishra Mr. Govind is a passiona…

When there was an announcement of tax rebate for a…

Opportunity cost is part and parcel of your life.…

Savings are used to purchase properties and financ…

Imagine that you are in need of extra funds to mee…

As a business-owner, you invest a considerable amo…

What is Loan Against Property (LAP)? Over the yea…

To win something, you need to lose something…

Business Loan in Cities

Get Business Loan

- Business Loan EMI Calculator

- Business Loan Rates and Charges

- Business loan documents

- MSME loan

- Business Loan eligibility

- Business loan for Women

- Business loan for Manufacturers

- Defination of Business

- Booming Business Ideas in Kerala

- What is udyam registration

- Sources of Start up financing

- Types of working capital management

- How to start a construction company in india

- Difference between micro small medium enterprises

- Best zero investment business ideas

- Business finance meaning

- Business ideas

- Loan restructruing vs Loan refinancing