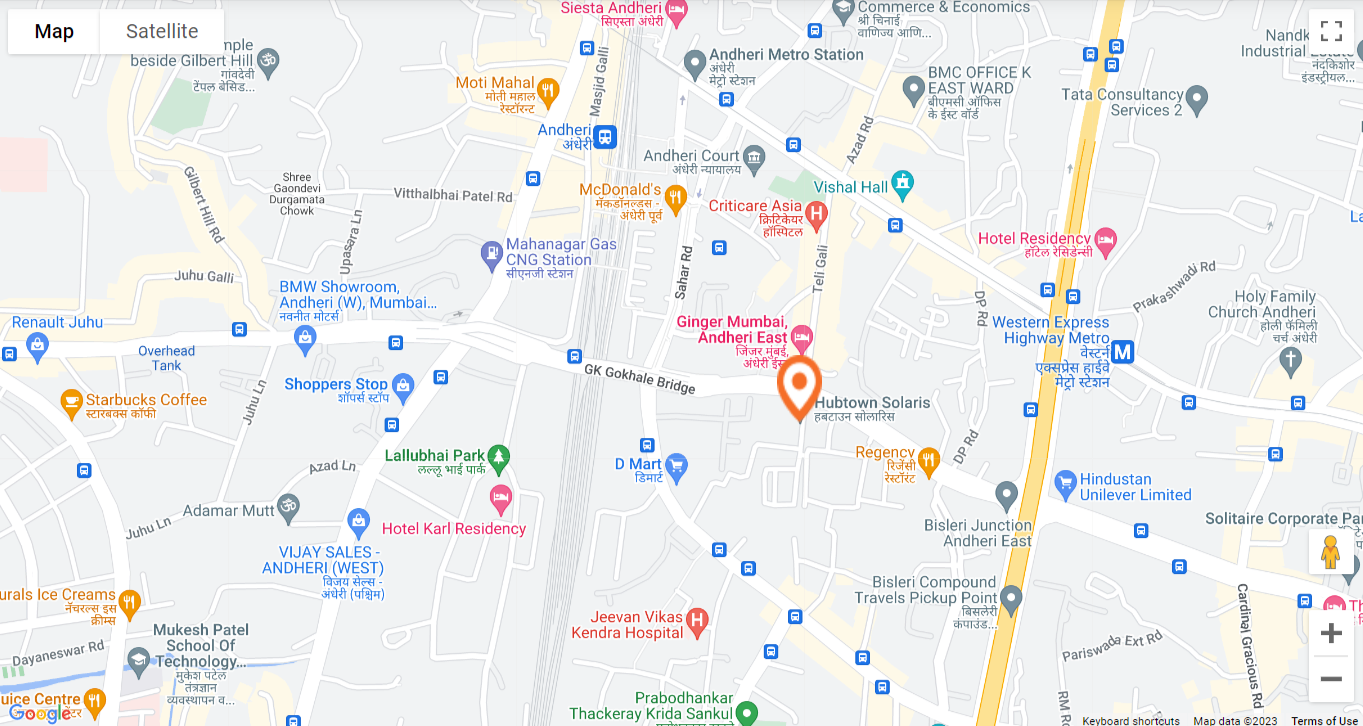

Find Nearest IIFL Branch - Locate Us for Your Finance Needs

No Branches Found.

Gold Loan Eligibility Criteria

From loan application to disbursement, the IIFL Finance gold loan process is streamlined in order to make it simple for applicants to get a loan without any hassle. You can apply for a gold loan online or by visiting any of our 2,800+ branches across India.

Following is the Eligibility criteria for getting a gold loan through IIFL Finance: