Business Loan

Business loans are vital for entrepreneurs looking to kickstart or expand their businesses. IIFL Finance’s range of financial products has continually innovated to cater to businesses that seek funds. IIFL Finance’s small business loan is designed to fulfil capital requirements for small and medium enterprises. The MSME business loan is a comprehensive product that offers quick funds to help you grow your small business and invest in vital infrastructure, machinery, plants, operations, advertising, marketing etc.

IIFL Finance’s online business loan is the ideal loan for a new business as a source of capital for all your business needs. The business loan interest rate is attractive and affordable to ensure you do not have to cut down on essential expenses of your business. Through extensive market research, the instant business loan process is tailored to ensure that it is at par with being the best business loan in India.

Apply for an instant business loan from IIFL Finance today and watch your business soar to new heights of success!

Business Loan EMI Calculator

IIFL Finance Business Loan Features

Business Loan Interest Rates and Charges

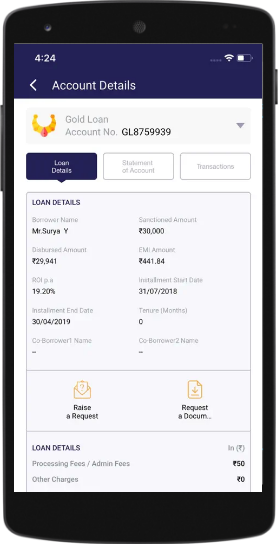

IIFL Finance’s loan rates and charges do not restrict you from investing the desired amount in your business. With an attractive business loan interest rate, your monthly EMIs are absolutely affordable. Furthermore, IIFL Finance’s instant business loan comes with utmost transparency and no hidden costs. The MSME loan details are presented at the time of application to ensure you do not pay anything over the communicated rates and charges.

| BUSINESS LOAN UPTO | ₹ 50 Lakhs |

|---|---|

| RATE OF INTEREST | 12.75% - 44% Per Annum |

| LOAN PROCESSING CHARGES | 2% to 9% + GST |

| NACH / E-MANDATE BOUNCE CHARGES (IN RUPEES) | Upto Rs. 2500/ + GST (if applicable) |

Business Loan Eligibility Criteria

An applicant for a business loan must meet certain conditions to be eligible. These relate to the operational vintage of the business enterprise and the applicant's own borrowing history. Here are a few such conditions.

-

The business should be operating for at least two years at the time of applying for a loan.

-

Self-employed people, professionals such as doctors and CAs, and proprietorship concerns can also apply.

-

Charitable organisations, NGOs, and trusts are not eligible for a business loan.

-

The applicant should have a credit score, or CIBIL, score of 700 and above.

-

The business should not fall under any list of blacklisted businesses.

-

The office location should not be on any negative list.

IIFL Business Loan

Business Loan Documents

Here are the documents Proprietorship, Partnership and Pvt. Ltd/ LLP /One Person Company will need to submit to complete the application

-

- KYC documents – Identity proof and address proof of the borrower and all co-borrowers

- PAN Card of borrower and all co-borrowers

- Last (6-12 Months) months bank statement of main operative business account

- Signed copy of standard terms (term loan facility)

- Additional document(s) may be required for credit assessment and processing of loan request

- GST Registration.

- Previous 12 months’ bank statements

- Proof of business registration

- PAN Card and Aadhar Card copy of the Proprietor(s).

- Deed copy and company PAN Card copy in the case of partnerships

Business Loan Application Process

The business loan application process typically involves submitting the application, providing financial and business information, and performing a credit check. Keep your documents handy, such as tax returns, financial statements, and a business plan. You may also need to furnish additional information before approval. Once the loan is approved, you need to sign a loan agreement.

6 Million + Happy Customers

I am thankful to IIFL for fulfilling my finance requirement at the right moment. IIFL provided me with every detail of the loan through timely SMSes.

Savaliya Jitendrabhai Vinubhai

We are enjoy a delightful relationship with IIFL. We have found it extremely smooth and easy to get any information regarding our loans from them. Their processes are well-defined and loans are disbursed within agreed timelines. There is complete co-operation from the entire team and we look forward to borrow more from IIFL in the future.

Rajesh Maheshwari

Customer Support

Business Loan FAQs

A business loan caters to the capital requirements for various purposes such as infrastructure, operations, manufacturing, expansion, advertising, marketing etc.

You can speed up your loan approval by applying for the loan online and completing eKYC.

You can use the business loan EMI calculator on the IIFL website to calculate the EMI for your loan.

The MSME loan interest rate differs from lender to lender. While banks charge lower rates compared to NBFCs, the application is processed faster by NBFCs. The current rate of interest starts from 12.75% - 44% per annum.

An MSME business loan is offered to Micro, small and medium enterprises.

Yes, it benefits the business as you can use the funds to invest in the business and ensure smooth operations.

If your business fulfils the eligibility criteria mentioned above, you can get a business loan for your SME from IIFL Finance.

Yes, part payment is allowed. However, as it varies from lender to lender, you should ensure the lender has this facility.

Proprietorship, Partnership and Pvt. Ltd/ LLP /One Person Company can avail of a business loan.

With IIFL Finance, you can take a loan of up to Rs 50 lakh.

Yes, a salaried employee can apply. The minimum age of the applicant must be 23 years and the maximum age must be 65 years. The applicant must have a monthly income greater than Rs 25,000.

You can apply by filling in the online loan application and uploading the required KYC documents.

Yes, the Prepayment / Foreclosure (01-06 months of EMI repayment) charges are 7%+ GST.

IIFL Finance seeks a CIBIL score, more than 700 to grant a business loan to borrowers.

You can check the status of your loan application at the time of filling up the form or you can call us at 022-62539302 to find out.

Yes, you can. A business loan can be used for a variety of purposes including for paying vendors, buying inventory and managing working capital.

No, IIFL Finance doesn’t allow any change in the due date of the EMI once the loan agreement has been signed.

Not necessarily! Business loans often fall under the unsecured loan category, meaning you don't need to pledge any assets like property or equipment as collateral. However, this depends on various factors like the loan amount, your business's financial health, and your creditworthiness. Some lenders might require a personal guarantee, especially for larger loans or if you're a new business. It's always best to check with the specific lender you're interested in to understand their requirements.

The diverse world of business loans caters to various needs. Here's a breakdown of some common types:

IIFL Insights

A business always needs finance for its expansion…

India's startup ecosystem is booming like never b…

The Micro, Small & Medium Enterprises (MSME)…

In today’s dynamic environment, the desire to own…