What Is A Cancelled Cheque & How Do You Write A Cancelled Cheque?

Table of Contents

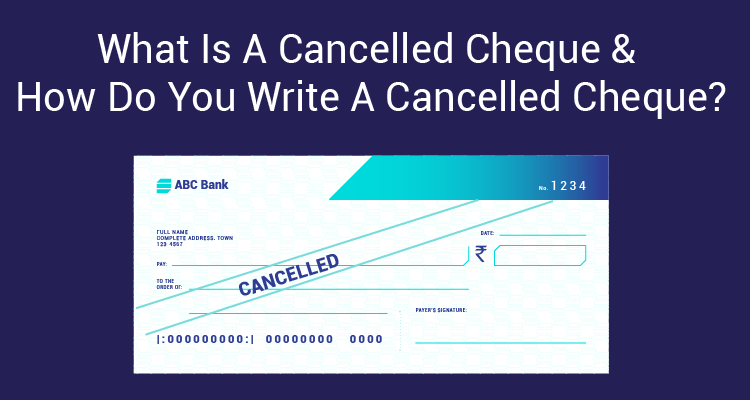

A cancelled cheque is one marked with two lines and the word "cancelled" written across it. The intent was essentially in case of mistakes made when writing the cheque, but it is unnecessary to write anything else besides "cancelled."

However, another purpose of cancelling a cheque is to prevent it from being misused. Despite this, a cancelled cheque indicates that the person has a bank account. Although you cannot use it to take money out of the account, it includes information such as the account holder's name, account number, MICR code, IFSC code, bank name and branch location, and cheque number.

This article explains what a cancelled cheque is and how to write a cancelled cheque in detail.

What Is The Purpose Of A Cancelled Cheque?

You cannot use a cancelled cheque to withdraw funds, but it has other uses, including the following.• Know Your Customer (KYC) procedures for investing in mutual funds or stocks, as it provides proof of a bank account and account holder information.

• Equated Monthly Installments (EMI) for loans such as car loans, education loans, and home loans. The bank or lending company requires a cancelled cheque for the monthly payment.

• Opening a Demat account to hold shares electronically. A cancelled cheque and other KYC documents, such as proof of identity and address, are required.

• Electronic Clearance Service (ECS) for electronic funds transfers between bank accounts. A cancelled cheque is needed to set up the monthly deduction.

• Withdrawing Employee Provident Fund (EPF) money. A cancelled cheque is required to verify account details.

• Insurance policies, as some organisations, may require a cancelled cheque from the policy buyer.

How To Write A Cancelled Cheque?

It is essential to cancel a cheque to ensure correct usage. To cancel a cheque for a specific purpose, follow these steps:Step 1:

Obtain a new cheque from your cheque-book and do not sign it.Step 2:

Draw two parallel lines across the cheque.Step 3:

Write "CANCELLED" in capital letters between the two lines.Please note the parallel lines should not cover important information such as the account number, account holder name, IFSC code, MICR code, bank name and branch address, etc.

If you cancel a cheque due to an error, begin with step 2.

When providing a cancelled cheque to someone, ensure that it is not signed and handed over to the appropriate person in charge to ensure safety.

Apply For A Loan With IIFL Finance

Applying for a loan with IIFL Finance is simple. The first step is determining your loan eligibility and the amount you need. You can do this by using the loan eligibility calculator on the IIFL Finance website. Once you have this information, you can complete the loan application form online.

You will need to provide your personal information. You may also be required to submit supporting documents such as proof of identity and address. Once the application is complete and after submitting all the necessary documents, IIFL Finance will process the application and get back to you with an approval or rejection within a few working days. If approved, you will receive the loan amount in your account.

Frequently Asked Questions

Q.1: How to write a cancelled cheque?

Ans: A cancelled cheque is written by drawing two parallel lines on a sheet of cheque and the word "cancelled" written across it.

Q.2: Why is a cancelled cheque used?

Ans: Previously, in case of mistakes made when writing the cheque, it was cancelled. But, it is unnecessary to write anything else besides "cancelled." The purpose of cancelling a cheque is to prevent it from being misused.

Disclaimer : The information in this blog is for general purposes only and may change without notice. It does not constitute legal, tax, or financial advice. Readers should seek professional guidance and make decisions at their own discretion. IIFL Finance is not liable for any reliance on this content. Read more