IIFL Finance - Instant Gold Loan & Business Loan In India

Calculators

Across India, millions of MSMEs quietly power our everyday progress.

Their ideas spark innovation. Their efforts build communities. Their spirit drives the nation forward. At IIFL Finance, we honour their resilience, their relentless drive, and the dreams they chase — not just for themselves, but for India’s tomorrow. Our MSME Anthem isn’t just a song. It’s a tribute to their journey built on courage, sustained by hope, and driven by purpose. Because every small step they take brings the nation one step closer to tarakki. And we’re proud to walk beside them.

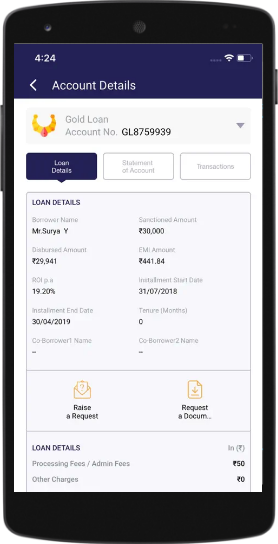

Quick pay

Now you can make payment - anytime, anywhere. Experience the ease of paying your

loan with our online payment system. It is quick, easy, convenient and safe.

-

-

-

-

-

Over 8+ Million Happy Customers

I am thankful to IIFL for fulfilling my finance requirement at the right moment. IIFL provided me with every detail of the loan through timely SMSes.

Savaliya Jitendrabhai Vinubhai

I loved the way IIFL took my documents digitally while applying for personal loan and gave faster disbursal into my bank account. Thanks Team IIFL for giving me a truly seamless & digital experience.

Ashish K. Sharma

When I visited IIFL Finance it just took a few minutes to process the loan and the process was very transparent. I have advised my friends to get their gold loans from IIFL.

Venkatram Reddy

I needed the money for my daughter's marriage. I have taken many loans from IIFL and I am very happy with their services.

Chavada Labhuben

HomemakerCustomer Support

Hear From Our Happy Customers

IIFL Insights

Learn how to get a gold loan with ease. Discover e...

Financial modelling predicts a company's future pe...

Stay updated with the latest GST exemption list. D...

Learn how to get a gold loan with ease. Discover e...