Latest Blogs on Credit Score

Buy Now Pay Later (BNPL) has become one of the mos…

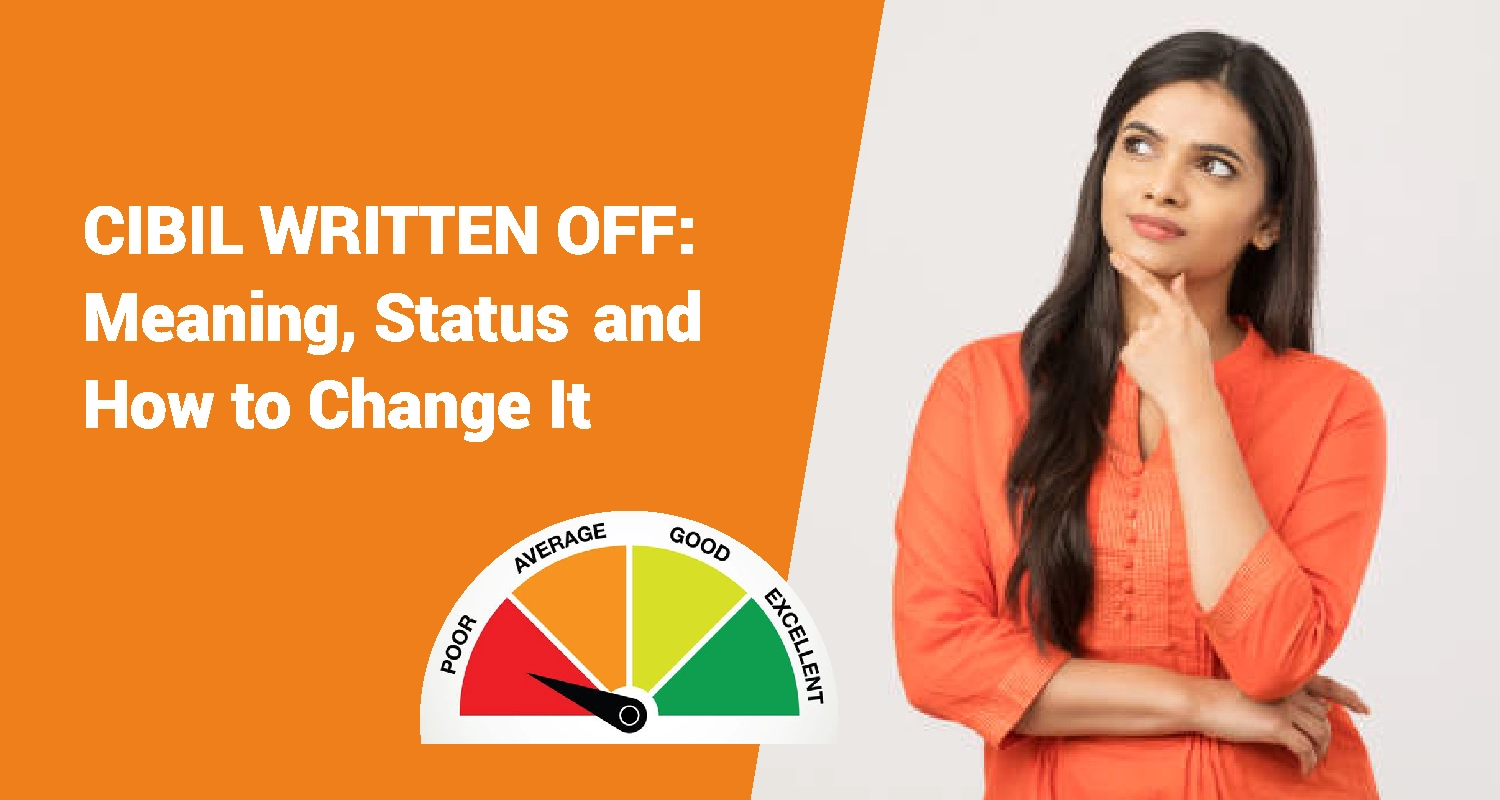

If you want to increase your probability of securi…

Today credit cards are powerful financial tools, b…

In today’s era of predominant usage of digital gad…