Business Loan in Telangana

The state of Telangana offers a favourable business environment with robust infrastructure, connectivity, and a well-developed industrial ecosystem. Its capital city, Hyderabad, is a major technology and IT hub, attracting global companies and talent. This provides access to a skilled workforce, research and development facilities, and cutting-edge technologies. In simple words, there’s no dearth of business opportunities. To accelerate this growth, capital investment is an absolute must. A comprehensive business loan comes in handy at such times.

IIFL Finance’s business loan in Telangana is among the most reliable names because of its hassle-free process with minimal documentation and attractive interest rates. There’s also the friendly customer support who are always ready to guide you every step of the way.

Features and Benefits of a Business Loan in Telangana

Telangana's strategic location in southern India offer access to domestic and international markets, making setting up and operating businesses easier. Keeping this in mind, most lenders have come up with business loans in Telangana that are tailor-made per the customers’ needs.

Let’s look at the major features and benefits of a business loan in Telangana:

Business Loan in Telangana EMI Calculator

Eligibility Criteria for Business Loans in Telangana

While applying for Telangana business loan schemes, you will be expected to fulfill specific eligibility criteria. It is advised to carefully consider everything before applying.

-

The company must have been operational for at least six months before applying.

-

At the time of application, the last three months' turnover should have totaled at least Rs. 90,000.

-

The company shouldn't be placed on a blacklist or list of excluded businesses.

-

The office or business location shouldn't be on the list of undesirable locations.

-

The company shouldn't be a charity, non-governmental organisation, or trust.

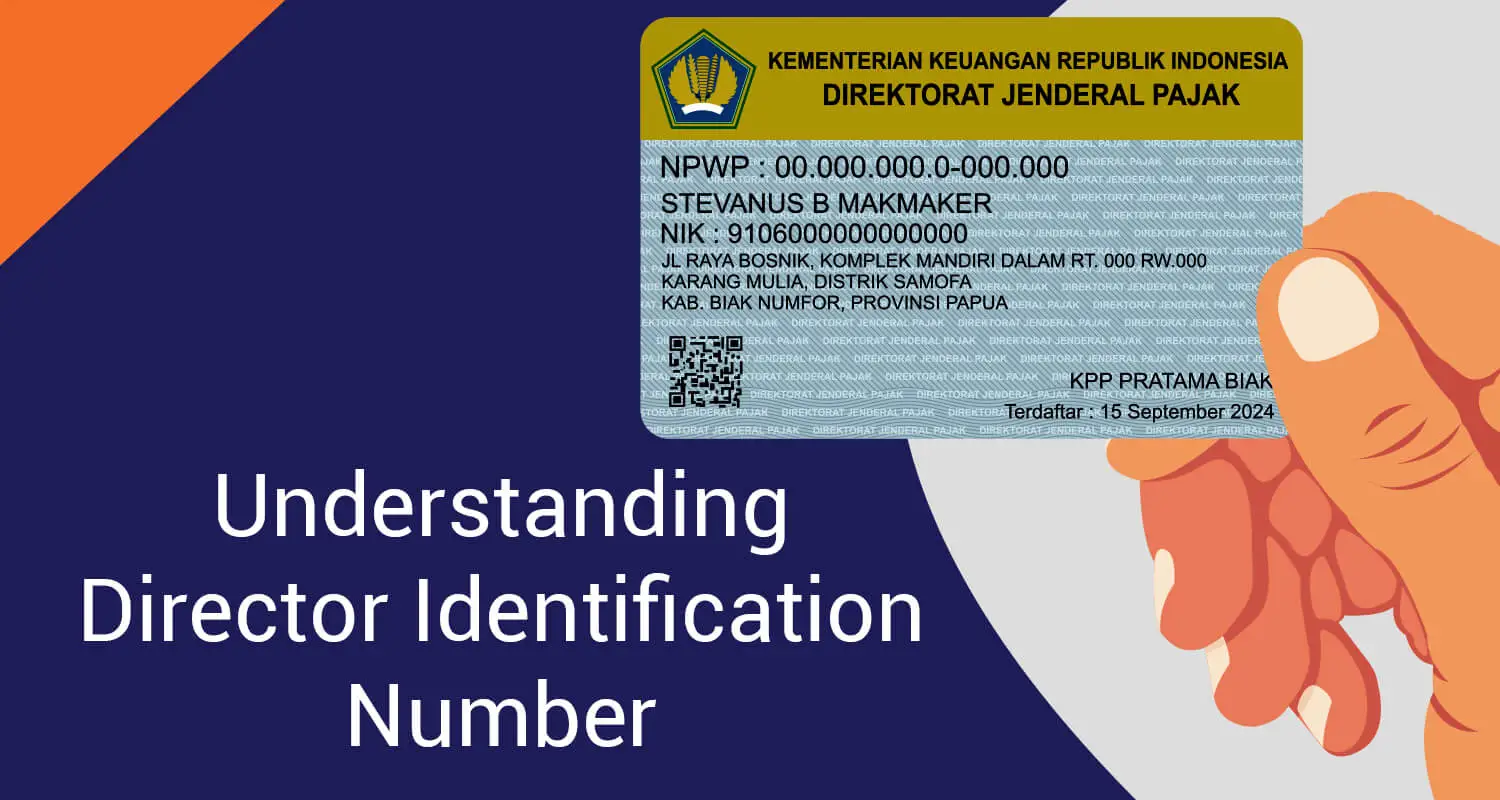

Documents required for a Business Loan in Telangana

If you are an entrepreneur looking for a business loan in Telangana, you must submit a few essential documents related to your business.

-

KYC records - Proof of the borrower's identity and addresses for each co-borrower

-

PAN cards for each co-borrower and the borrower

-

The last 6 to 12 months bank statements for the principal business account.

-

Standard terms of the term loan facility: signed copy

-

Additional document for the credit evaluation and loan application processing

-

GST Registration

-

PAN card and a copy of the proprietor(s)' Aadhar card

-

Bank statements from the last 12 months

-

Proof of business registration.

-

A copy of the partnership agreement and the company's PAN card

Business Loan Fees & Interest Rate

The interest rates and charges will remain variable on the basis of market conditions and macroeconomic factors. Nevertheless, in order for you to focus on meeting your business objectives and not worry about the financial burden, the Telangana business loan scheme will be customized and laid down at a reasonable price.

Why choose an unsecured business loan in Telangana?

Telangana boasts a thriving business ecosystem with access to mentoring, networking, and incubator facilities. You can use this helpful ecosystem and its resources for your company's success by selecting an unsecured business loan in Telangana.

An unsecured business loan in Telangana can help with:

-

Working Capital

-

Business Expansion

-

Equipment and Asset Purchase

-

Inventory Management

-

Cash Flow Management

-

Business Opportunities

-

Marketing and Promotion

-

Building Credit History

How to apply for a Business loan in Telangana?

The Telangana Government is taking initiatives to promote various big and small business endeavours and hence has made provision for special Telangana minority loans for businesses. If you are looking to apply for an IIFL Finance business loan, here's what you need to do:

-

-

Click "Apply Now" and complete the form.

-

Complete KYC by furnishing all the necessary paperwork.

-

Click the "Submit" button.

-

In less than 30 minutes after appraisal, IIFL Finance will approve the loan and deposit the funds into your bank account in the next 48 hours

So if you are actively looking for a business loan in Telangana, Don’t delay any further and apply now!

IIFL Business Loan Related Videos

Business Loan in Telangana FAQs

To address the concerns and hardships the Dalits in the State face, the Telangana Government has implemented the "Dalit Bandhu Scheme." The programme gives beneficiaries a one-time payout of Rs. 10,00,000, giving them a sense of financial security and hope for a better future. The Telangana government will support the recipients in making wise use of the financial aid.

Find Customised Business Loan For Your Business

Latest Blogs on Business Loans

The corporate landscape requires a strong system…

The GST, or Goods and Service Tax, system has bee…

Micro, Small and Medium Enterprises (MSMEs) are th…

MSMEs (Micro, Small, and Medium Enterprises) serv…