Business Loan In Morbi

In the heart of Gujarat, the city of Morbi stands as a testament to entrepreneurial spirit and industrial prowess. With its thriving ceramic and vitrified tile sector, Morbi has emerged as a dynamic economic hub. Yet, for enterprises to truly flourish, access to financial resources is paramount. This is where business loans step in, offering a vital lifeline to fuel growth and innovation. From the traditional corridors of lending institutions to the modern highways of online financing, the avenues are myriad and diverse. Yet, navigating this labyrinthine landscape demands wisdom, discernment, and a keen understanding of the dynamics that govern the financial realm.

Unravel the landscape of business loans in Morbi, shedding light on their types, advantages, application procedures, and crucial considerations. Embark on this journey to discover how these financial tools can propel Morbi's businesses toward unprecedented success.

Business Loans in Morbi Features and Benefits

Let's delve into the distinctive features and remarkable benefits of a business loan in Morbi, uncovering the pathways they pave for entrepreneurial triumph.

Business Loan in Morbi EMI Calculator

Eligibility Criteria for Business Loans in Morbi

When considering a business loan application in Morbi, adherence to specific qualifying conditions is paramount. It's imperative to comprehensively review these prerequisites prior to initiating the application process. Here are the essential business loan eligibility criteria:

-

Established businesses operating for more than six months at the time of application.

-

Minimum turnover of Rs 90,000 in the last three months from the time of application.

-

The business does not fall under any category or list of blacklisted/excluded businesses.

-

The office/business location is not on the negative location list.

-

Charitable organisations, NGOs, and trusts are not eligible for a business loan.

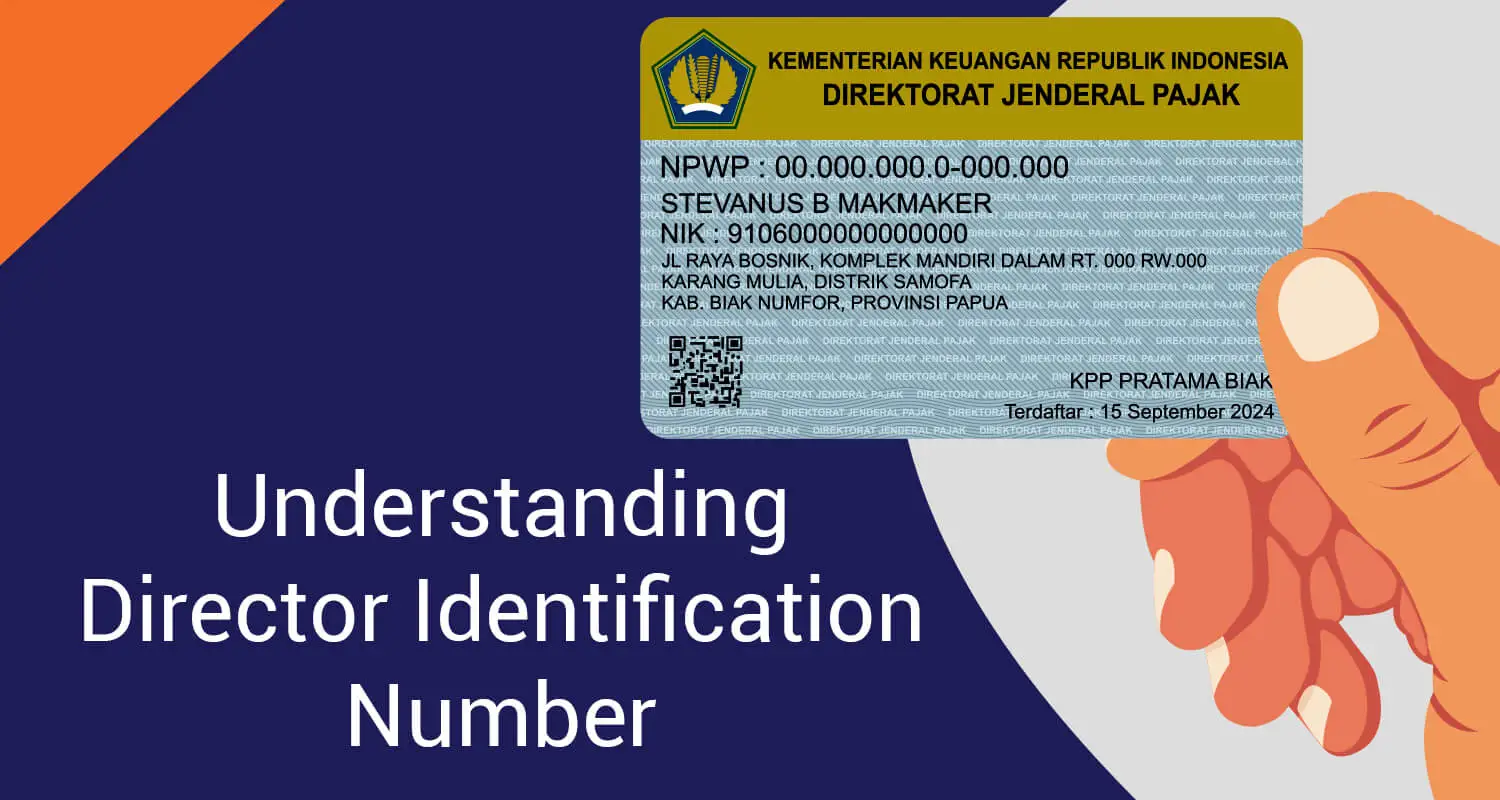

Documents Required For Business Loans in Morbi

Here's a comprehensive list of the essential business loan documents typically required when applying for a business loan in Morbi:

Business Loan Fees & Interest Rate

The interest rates and charges for business loans in Morbi may vary based on market conditions and financial factors. However, rest assured that the business loan interest rate in Morbi is strategically designed to suit your requirements and is maintained at a reasonable level. This ensures that you can focus on achieving your company's goals without being burdened by excessive costs.

Why choose an unsecured business loan in Morbi?

Selecting an unsecured business loan in Morbi presents an array of compelling benefits:

- Mitigated Risk for Borrowers

- Swift Approval and Disbursa

- Enhanced Cash Flow Management

- Effortless Application

- No Need for Collateral

How to apply for a Business loan in Morbi?

IIFL Finance offers a straightforward application process. So, if you want to apply for a business loan in Morbi from IIFL Finance, follow these steps:

-

Go to the business loan section of the IIFL Finance website.

-

Click "Apply Now" and complete the form.

-

Submit all the necessary paperwork to complete KYC.

-

Click the "Submit" button.

-

Following evaluation, IIFL Finance will grant the loan in under 30 minutes and deposit the money into your bank account within 48 hours.

Embarking on your business loan journey with IIFL Finance guarantees efficiency and promptness. If you're seeking a business loan in Morbi, don't hesitate any longer – seize this opportunity and apply today!

IIFL Business Loan Related Videos

Business Loan in Morbi FAQs

Begin by researching lenders to find the best fit for your needs, then determine the exact loan amount required. Check eligibility criteria and gather necessary documents, including proof of identity, financial statements, and business registration. After submitting your application, undergo evaluation based on financial health and creditworthiness. Upon approval, carefully review the loan offer's terms before accepting. Following acceptance, the loan amount will be disbursed to your business account, and repayment will commence as per the agreed schedule.

Yes, it is indeed possible to secure a business loan without collateral in Morbi. Many financial institutions, including banks and non-banking financial companies (NBFCs), offer unsecured business loans that don't require borrowers to provide collateral such as property, inventory, or assets as security. Instead, these loans typically assess the creditworthiness of the borrower based on factors like business turnover, profitability, cash flow, credit history, and the overall financial health of the business. This approach enables businesses in Morbi to access much-needed funding without the burden of collateral obligations, promoting flexibility and ease of borrowing.

Find Customised Business Loan For Your Business

Latest Blogs on Business Loans

The corporate landscape requires a strong system…

The GST, or Goods and Service Tax, system has bee…

Micro, Small and Medium Enterprises (MSMEs) are th…

MSMEs (Micro, Small, and Medium Enterprises) serv…